SupraFin Demo

Startup Name:

SupraFin

Founder / CEO Name & Title:

Liliana Reasor

Tagline:

Digital Asset (Crypto and Real-World Assets) Investment, Risk and Compliance Intelligence powered by AI.

Demo Spotlight:

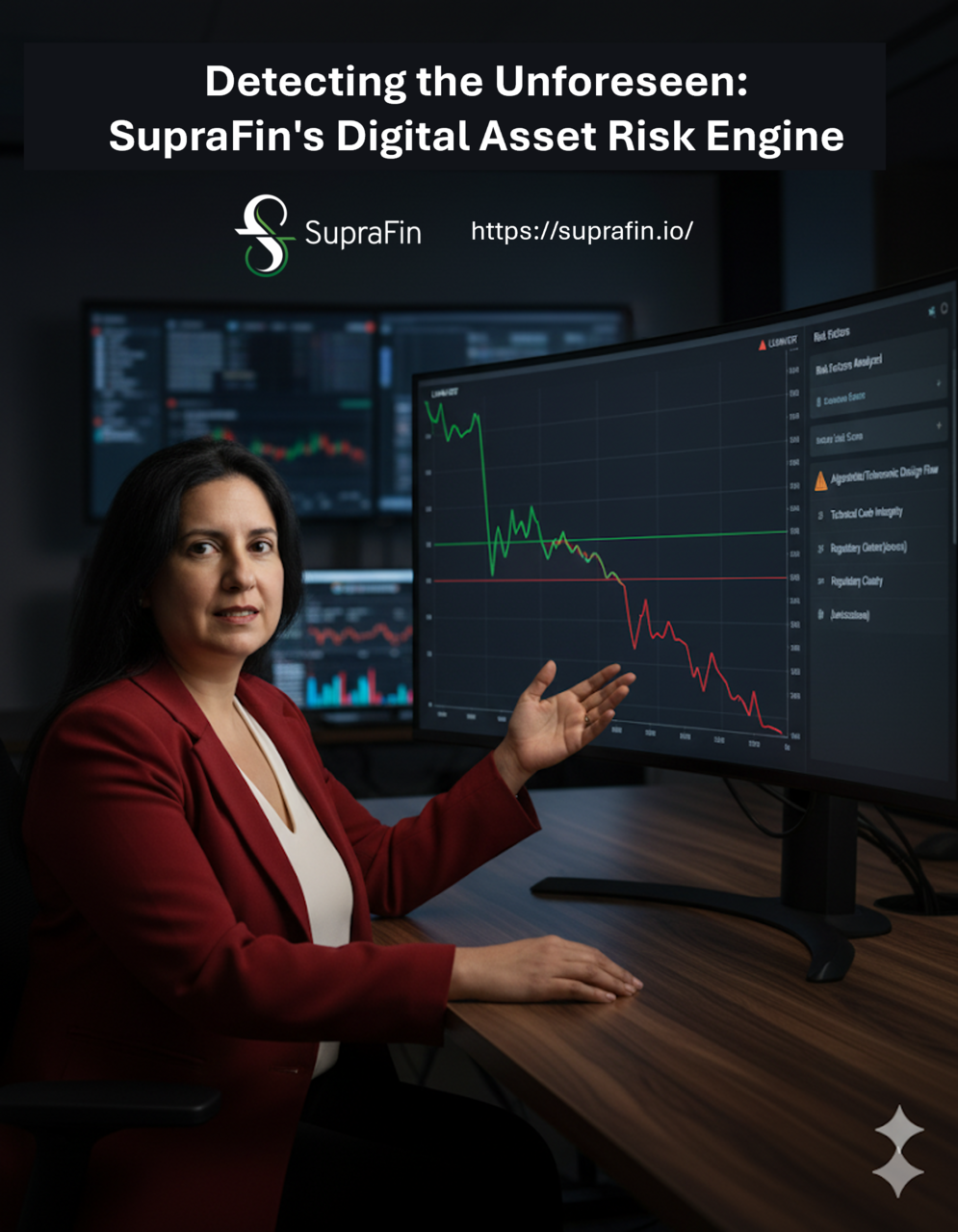

Our 10-minute demo, "Risk Architecture for the Digital Economy," showcases the unified, institutionally-driven framework required to manage risk across all digital assets, from established cryptocurrencies to tokenized Real-World Assets (RWAs). What Visitors Will See Visitors will see our proprietary risk system, built on principles from structured credit and portfolio risk (e.g., Morgan Stanley, Moody's Analytics), in action: Systemic Risk Proof: A quick, visual demonstration of the SupraFin Score predicting the LUNA/UST collapse. We will show that price and market data offered no warning while our fundamental risk score signaled danger weeks in advance. This proves our system is an early warning mechanism. RWA Risk Deep Dive: A dashboard view of our multi-factor scoring for a Tokenized Real-World Asset (RWA), highlighting the critical factors unique to tokenization: Legal Jurisdictional Risk, Custody Structure, and Underlying Asset Quality. Compliant Product Enablement: A showcase of our B2B2C WealthTech platform, illustrating how our risk scores instantly create MiCA- and FCA-compliant investment baskets mixing RWAs and crypto for end-clients. Why It Matters Our solution matters because traditional finance relies on market risk, which is a lagging indicator and completely fails in fast-moving crypto markets. Having worked in portfolio risk at Morgan Stanley and Moody's, we built a model that assesses fundamental risk (i.e., token design, decentralization)—the true leading indicators of failure. We solve the critical institutional problem of being reactive by providing the structural foresight necessary for scalable RWA tokenization and secure crypto investment. Key Takeaways for Visitors Attendees will learn how to: Move from Reactive to Predictive: Adopt a risk system based on leading fundamental indicators, leaving behind insufficient, lagging market metrics. Ensure Regulatory Defense: Gain an auditable, third-party defense (the "LUNA shield") against both systemic crypto risk and RWA structural failure. Unify Risk View: Implement a single, unified risk API for their entire digital asset portfolio, eliminating silos between traditional and blockchain risk teams.

Problem They Solve:

Digital Assets are complex to analyse, and there is a lack of risk/investment solutions to assess them properly.

Year Founded:

2018

Headcount / Team Size:

10

Stage:

Series A

Currently Raising?:

Yes

)

)